Are you looking to enhance your trading skills and maximize your profitability in the financial markets? Look no further than copy trading! If you’re unfamiliar with the term, copy trading is a revolutionary concept that allows traders to automatically copy the trades and strategies of experienced and successful investors. In this article, we will explore the definition and explanation of copy trading, delve into its numerous benefits and advantages, and witness its skyrocketing popularity in the financial world.

Definition and Explanation of Copy Trading

Copy trading, also known as mirror trading or social trading, is a method where investors replicate the trading actions of professional traders. Instead of tirelessly analyzing the markets and making decisions based on limited knowledge, copy trading enables traders to link their brokerage account with a seasoned trader’s portfolio. This way, every trade executed by the expert is automatically copied onto the follower’s account, ensuring the same trades are executed in real time.

Benefits and Advantages of Copy Trading for Traders

Copy trading opens up a world of opportunities for traders, especially those looking to grow their portfolio efficiently. Firstly, it allows novice traders to learn from the strategies of experienced investors in real-time. By observing and copying their trades, newbies gain valuable insights into successful trading techniques and can improve their decision-making skills. Additionally, copy trading saves time as traders can rely on established experts instead of spending endless hours analyzing the markets. Furthermore, it minimizes emotional decision-making as trades are executed based on proven and rational strategies, reducing the chances of impulsive actions driven by fear or greed.

Overview of the Popularity and Growth of Copy Trading

Copy trading has witnessed explosive growth and garnered immense popularity in the financial markets. This surge in demand can be attributed to the transparency, convenience, and potential for profitability it brings to traders. Many online platforms and brokerages now offer copy trading features, attracting a wide range of users, including both retail and institutional investors. As more traders recognize the advantages of copy trading, its influence and presence continue to expand rapidly.

Trading Platforms for Copy Trading

Copy trading has gained popularity in recent years as a way for novice traders to benefit from the expertise of experienced traders. Several trading platforms offer the copy trading feature, making it easier for individuals to replicate trades made by successful traders. Here is an overview of some popular trading platforms that provide this useful feature:

eToro

eToro is one of the leading trading platforms for copy trading. It allows users to automatically copy trades made by top-performing traders, known as Popular Investors. eToro provides a user-friendly interface, making it suitable for beginners. Additionally, it offers a variety of trading instruments and social trading features, such as the ability to interact with other traders and discuss strategies.

ZuluTrade

ZuluTrade is another noteworthy platform that specializes in copy trading. It provides a wide range of trading strategies to choose from and allows users to copy trades from experienced traders. ZuluTrade also offers advanced risk management tools to help users control their investments. With its transparent performance statistics, users can assess the track record of traders before deciding to copy their trades.

Tradency

Tradency is renowned for its mirror trading platform, which allows users to automatically execute trades based on the strategies of professional traders. It offers a diverse range of trading strategies and provides detailed trading performance reports. Tradency also emphasizes user-friendly features, making it accessible to traders of all levels of experience.

Roboforex

Roboforex is a popular trading platform that offers copy trading functionality. It enables users to replicate trades of successful traders seamlessly. The platform provides a wide range of trading instruments, competitive spreads, and flexible copy trading options. Roboforex also offers a comprehensive analysis toolkit to help users make informed decisions about which traders to follow.

Varianse

Varianse is considered one of the best platforms for copy trading. It allows users to easily copy trades of successful traders and offers a wide range of trading instruments. Varianse prioritizes user experience by providing intuitive trading interfaces and extensive educational resources. With its secure platform and reliable customer support, Varianse is an ideal choice for those looking to engage in copy trading.

Each of these trading platforms has its unique features and functionalities. Before choosing a platform, it is advisable to compare the key features, user reviews, and overall performance statistics. This way, traders can select the platform that best suits their individual trading needs and preferences.

Social Trading and Copy Trading

Explanation of the relationship between social trading and copy trading

Social trading and copy trading go hand in hand to revolutionize the way we trade in the financial markets. Social trading is a concept that allows traders to connect, interact, and share their trading ideas and strategies. This enables beginners to learn from experienced traders, while experienced traders can benefit from the collective knowledge of the community.

Copy trading, on the other hand, takes social trading to the next level by allowing traders to automatically replicate the trades of more experienced and successful traders. By copying the trades of these experts, novice traders can take advantage of their skills and expertise without having to actively trade themselves.

Benefits of social trading in terms of knowledge sharing and community engagement

Social trading brings several benefits to traders of all levels:

- Knowledge sharing: Social trading platforms provide a space for traders to share their trading strategies, insights, and market analysis. This knowledge sharing can help traders improve their trading skills and make better-informed trading decisions.

- Community engagement: Social trading fosters a sense of community among traders. Traders can interact, discuss trading ideas, and gain support from like-minded individuals. This sense of belonging and support can be valuable, especially for beginner traders who may feel isolated in their trading journey.

- Crowdsourced wisdom: Social trading platforms aggregate the trades and insights of multiple traders, creating a pool of collective wisdom. Traders can tap into this wealth of information and follow the trades of successful traders who have a proven track record.

Examples of successful social trading platforms and their impact on copy trading

Several social trading platforms have emerged as leaders in the industry, revolutionizing the way traders connect and engage:

- eToro: eToro is one of the pioneers of social trading and copy trading. It offers a user-friendly platform where traders can connect, follow successful traders, and copy their trades. With a diverse community of traders, eToro provides an excellent environment for knowledge sharing and copy trading.

- ZuluTrade: ZuluTrade is another popular social trading platform that enables traders to follow and copy the trades of expert traders. With its advanced algorithm and filtering options, ZuluTrade empowers traders to choose from a wide range of successful traders and strategies.

- Ayondo: Ayondo is known for its innovative social trading features, such as the ability to follow and copy “Top Traders” who have demonstrated consistent profitability. Ayondo’s platform also offers a social feed where traders can interact, share ideas, and gain insights from each other.

These successful social trading platforms have had a significant impact on the copy trading landscape, democratizing access to the financial markets and empowering traders of all levels to participate in trading.

Investment Strategies in Copy Trading

Copy trading offers the opportunity to replicate the investment strategies of successful traders. Here, we provide an overview of different investment strategies that can be followed in copy trading:

Trend Following

Trend following strategy involves identifying and following the prevailing trends in the market. Traders who follow this strategy aim to ride the upward or downward movement of an asset based on its current trend.

Swing Trading

A swing trading strategy involves taking advantage of short-term price fluctuations within a longer-term trend. Traders who follow this strategy aim to capture the “swings” in price movements that occur within a certain time frame.

Mean Reversion

The mean reversion strategy involves identifying assets that have deviated from their average price and betting on their return to the mean. Traders who follow this strategy aim to profit from the correction of price imbalances.

Scalping

The scalping strategy involves making multiple quick trades to profit from small price movements. Traders who follow this strategy aim to take advantage of short-term opportunities and generate small but frequent profits.

Each investment strategy has its characteristics and suitability for copy trading. Trend following and swing trading strategies are popular among copy traders as they rely on identifiable trends and can be executed over a longer time frame. Mean reversion and scalping strategies, on the other hand, require closer monitoring and quick execution.

Case studies of successful investment strategies in copy trading can provide valuable insights. By analyzing the performance of traders who have consistently applied specific strategies, copy traders can gain inspiration for their investment approaches.

Risk Management in Copy Trading

Copy trading can be a lucrative investment strategy, but it’s crucial to implement effective risk management techniques to safeguard your funds.

Importance of effective risk management in copy trading

When it comes to copy trading, understanding, and managing risks is vital for long-term success. The highs and lows of the financial markets can have a significant impact on your investments, so having a solid risk management plan can help minimize potential losses.

Discussion on risk assessment methods and tools

To effectively manage risks in copy trading, it’s essential to conduct a thorough risk assessment. This involves evaluating the risk potential of each copied trader, analyzing market conditions, and assessing the overall risk exposure of your portfolio. Various tools and platforms are available to assist you in this process, providing valuable insights and data to make informed decisions.

Explanation of portfolio diversification techniques for risk mitigation

Diversifying your copy trading portfolio is another crucial risk management technique. By spreading your investments across different traders, assets, and markets, you decrease the exposure to any single risk factor. This strategy helps reduce the impact of potential losses by ensuring that not all your eggs are in one basket.

Overview of stop-loss orders and their role in managing risks

Stop-loss orders are an effective risk management tool in copy trading. These orders automatically close a trade when it reaches a specified price level, limiting potential losses. By setting stop-loss orders, you can protect your investments from unexpected market fluctuations and control your risk exposure.

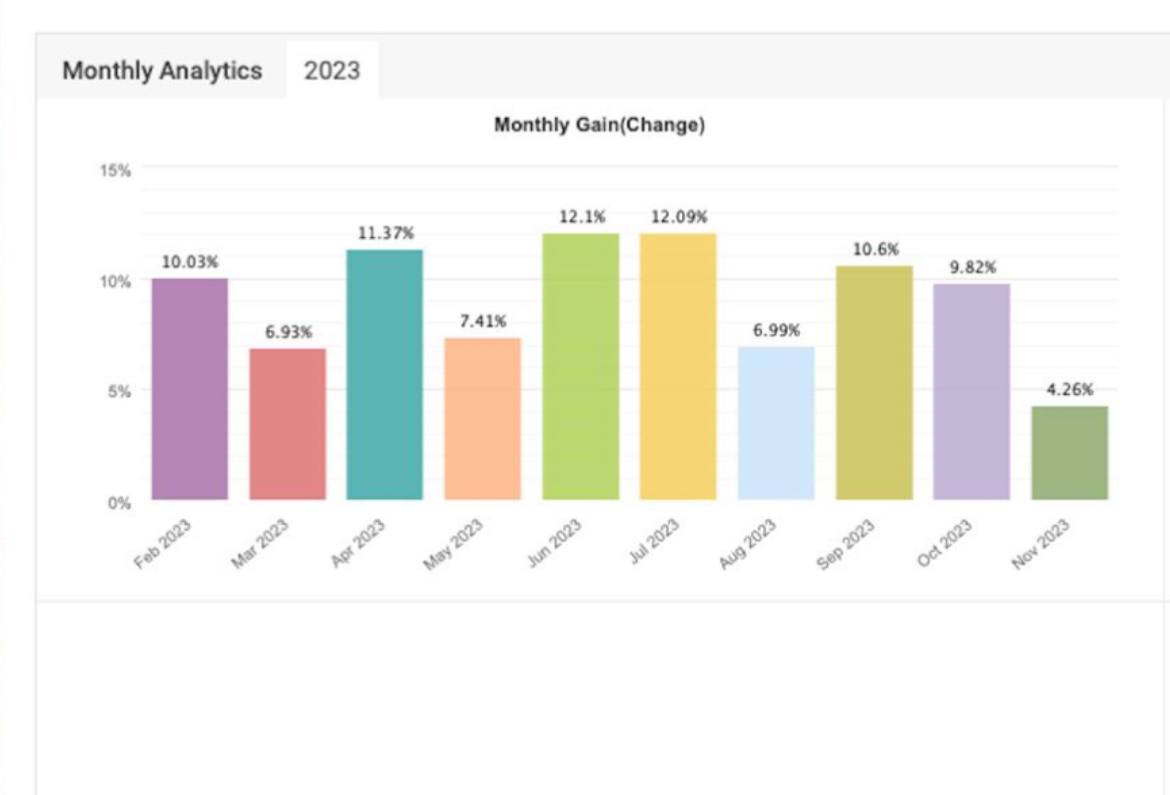

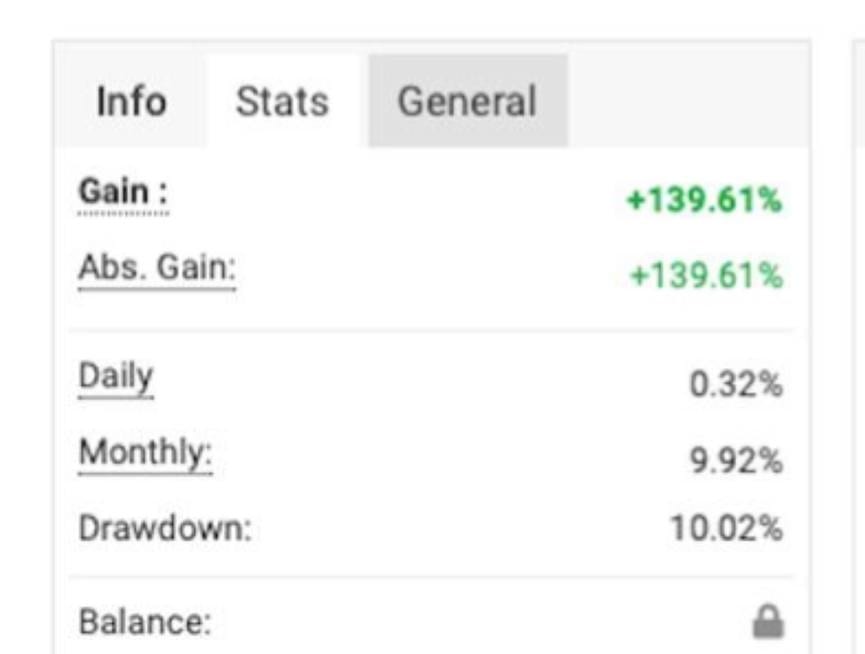

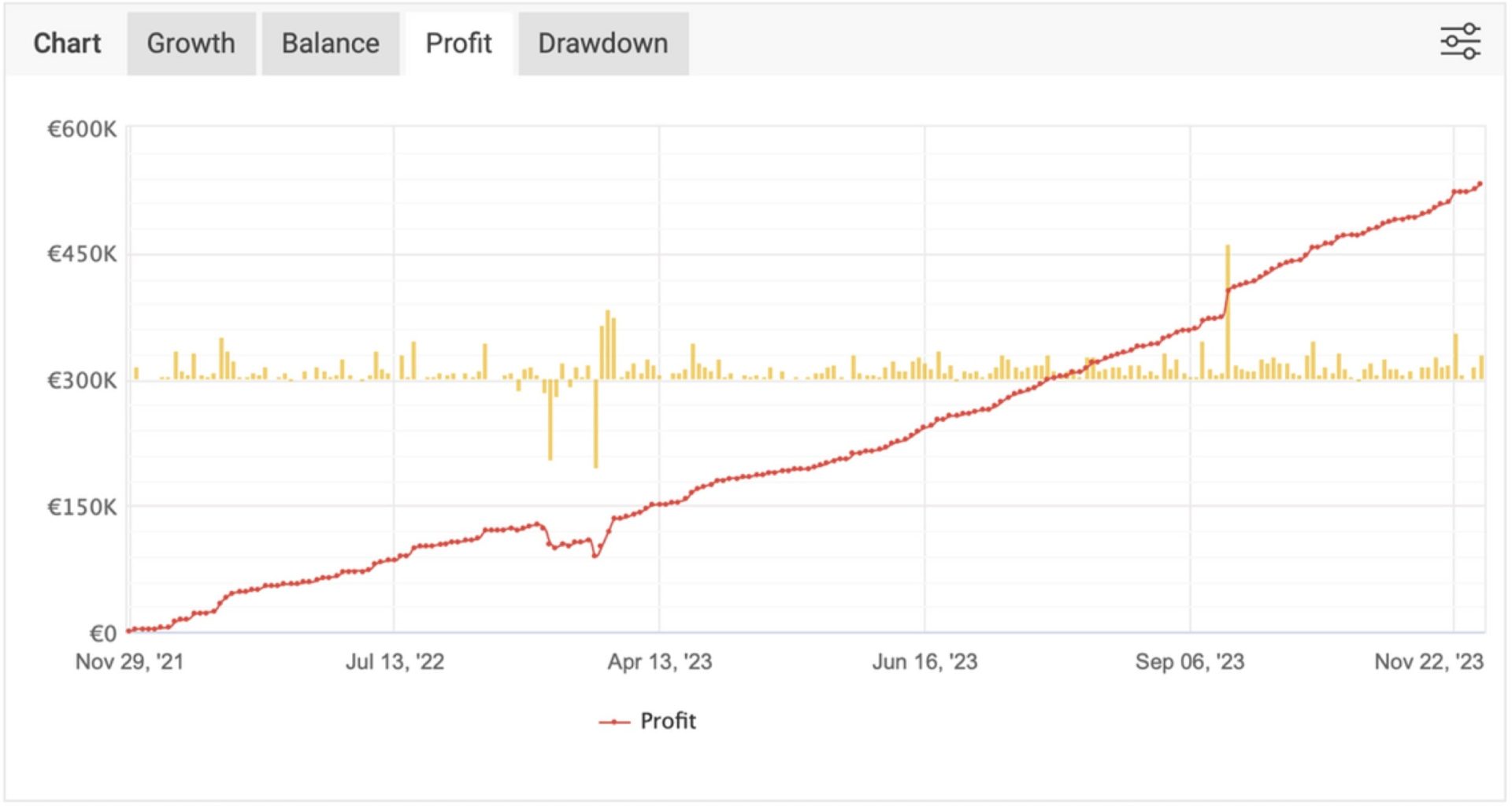

Performance Statistics in Copy Trading

When it comes to copy trading, analyzing performance statistics is crucial before choosing a trader to copy. By evaluating their past performance, you can make informed decisions and increase your chances of success. Let’s take a closer look at the importance of performance statistics and the key metrics used in assessing traders:

Importance of Analyzing Performance Statistics

Before hitting the “copy” button, it’s crucial to delve into the performance statistics of potential traders. This analysis allows you to gain insights into their trading strategies, risk appetite, and consistency over time. By scrutinizing their performance, you can identify whether they align with your financial goals and risk tolerance.

Key Performance Metrics

Here are the key performance metrics commonly used to assess traders:

- Win/Loss Ratio: This metric indicates the ratio of winning trades to losing trades. A higher win/loss ratio generally suggests a trader’s ability to make profitable trades consistently.

- Average Profit/Loss: This metric reveals the average profit or loss per trade made by a trader. A higher average profit is desirable, as it indicates the potential for generating positive returns.

- Maximum Drawdown: The maximum drawdown highlights the largest decline a trader’s account has experienced in the past. A lower maximum drawdown implies better risk management and stability in their trading strategy.

- Return on Investment (ROI): ROI measures the percentage gain or loss on an investment relative to the initial capital. A higher ROI indicates more profitable trades and a better overall return on investment.

Tips for Interpreting Performance Statistics

Here are some tips to help you interpret performance statistics effectively and make informed decisions:

- Consider the time period analyzed – Evaluate performance over a significant period to ensure consistency and account for market fluctuations.

- Look for a good balance between risk and reward – A trader with high returns may also carry higher risk. Assess if their risk level aligns with your risk tolerance.

- Verify the trader’s trading style – Some traders may employ short-term scalping strategies, while others focus on long-term investments. Choose a trader whose style matches your investment goals.

- Diversify your portfolio – Copying multiple traders with varying performance statistics can help spread risk and provide a more balanced trading approach.

Choosing Followed Traders in Copy Trading

In the world of copy trading, the process of selecting the right traders to follow can make or break your investment journey. With so many options available, it’s crucial to carefully analyze trader profiles and understand their significance in the copy trading process.

When choosing followed traders, it’s essential to evaluate their performance records and trading styles. This thorough analysis will give you a deeper understanding of their strategies and help you make informed decisions about who to copy.

Furthermore, setting specific criteria for selecting traders to copy is of utmost importance. By determining your risk tolerance, preferred investment duration, and desired returns, you can narrow down your options and find traders who align with your investment goals.

Remember, every trader is unique, and what works for one may not work for another. That’s why it’s essential to tailor your selection process to your individual needs and preferences.

Regulations and Guidelines in Copy Trading

When it comes to copy trading, there are various regulations and guidelines imposed by financial authorities to ensure a safe and transparent trading environment.

The legal aspects of copy trading involve licensing requirements and compliance with industry standards. Financial authorities enforce these regulations to protect investors and maintain the integrity of the financial markets.

Investor protection measures are put in place to safeguard the interests of individuals participating in copy trading. These measures may include risk disclosures, transparency requirements, and capital adequacy regulations.

Compliance with industry standards and best practices is crucial for both traders and platform providers in copy trading. By adhering to these standards, traders can ensure fair trading conditions and mitigate potential risks.

It is important to understand and comply with the regulations and guidelines set forth by financial authorities when engaging in copy trading. This will help you make informed investment decisions and protect your investments.

Copy Trading Techniques

Copy trading offers a variety of techniques and methods that traders can employ to maximize their chances of success. Here are some key techniques to consider:

Signal-based copying

One technique in copy trading involves following and copying trades based on signals generated by experienced traders. These signals can indicate potential profitable opportunities in the market. By closely monitoring and copying these signals, traders can potentially replicate the success of the signal provider.

Percentage-based copying

Another popular technique is percentage-based copying. In this method, traders allocate a fixed percentage of their trading capital to copy the trades of another trader. This allows them to mirror the trading decisions and risk management strategies of a successful trader, while maintaining control over their overall portfolio.

Mirror trading

Mirror trading is a technique that involves automatically duplicating the trades of a chosen trader. This technique allows traders to mirror the exact trading positions, including entry and exit points, of a successful trader. It can be particularly useful for those who want a hands-off approach to copy trading.

Machine-learning-based algorithms

With advancements in technology, machine-learning-based algorithms have emerged as a powerful tool in copy trading. These algorithms analyze vast amounts of historical trading data to identify patterns and trends. By using these algorithms for trade selection, traders can potentially improve their chances of making profitable trades.

By exploring and implementing these copy trading techniques, traders can enhance their overall trading strategies and increase their chances of success in the financial markets.

Community Discussions and Support

Joining an online community or forum is crucial for any copy trader seeking to learn, share, and connect with like-minded individuals. These platforms provide a space for discussions, support, and the exchange of valuable insights.

Importance of Online Communities and Forums

Online communities and forums offer a wealth of information and support for copy trading enthusiasts. Here’s why they are vital:

- Knowledge Sharing: Community members willingly share their experiences, strategies, and lessons learned, enabling newcomers to gain valuable insights.

- Tips and Tricks: Seasoned copy traders often share tips, tricks, and best practices, helping others refine their strategies and improve their performance.

- Learning Opportunities: Engaging in discussions with experienced traders offers a fantastic learning opportunity, allowing individuals to expand their knowledge and skills.

- Support Network: When facing challenges or uncertainties, the community provides a support network where members can seek guidance and advice from others who have encountered similar situations.

Sharing Experiences, Tips, and Lessons Learned

Communities and forums are excellent platforms for sharing experiences and lessons learned in the world of copy trading. Here are some ways you can contribute:

- Case Studies: Share your success stories, detailing the strategies employed and the outcomes achieved. This can inspire and educate others, providing real-life examples of copy trading in action.

- Lessons Learned: Reflect on any mistakes made or challenges faced during your copy trading journey. By sharing these lessons, you can help others avoid similar pitfalls, fostering a stronger copy trading community.

- Tips and Recommendations: Offer practical tips and recommendations based on your experiences. Share strategies that have worked well for you or suggest trusted resources that have enhanced your copy trading skills.

Troubleshooting Common Issues and General Q&A

Community discussions and support forums are invaluable when it comes to addressing common issues and providing answers to general questions related to copy trading. Here’s how these platforms can assist:

- Troubleshooting: Are you experiencing technical difficulties or encountering challenges with your chosen trading platform? Seek assistance from the community, where members can offer troubleshooting advice or suggest alternative solutions.

- General Q&A: Engage in Q&A sessions to obtain answers to specific queries about copy trading, including topics like risk management, platform selection, and performance analysis.

- Community Feedback: Use these platforms to gather feedback from other copy traders. Ask for opinions on specific strategies, seek suggestions for improving your approach, or request an analysis of your trading performance.

Remember, a thriving copy trading community relies on active participation and contribution from its members. By engaging in discussions, sharing experiences, and seeking support, you position yourself to learn and grow alongside fellow traders.

Educational Resources for Copy Trading

Are you interested in learning more about copy trading? Whether you’re a novice or an experienced trader, there are various educational resources available to help you improve your copy trading skills and knowledge.

- Overview of educational resources: Gain an understanding of the different resources available for both beginners and advanced traders in the field of copy trading.

- Tutorials, webinars, articles, and courses: Explore the wide range of educational materials focused specifically on copy trading. These resources are designed to provide you with in-depth knowledge and practical skills to enhance your copy trading strategies.

- Reliable and trusted sources: It’s important to rely on credible educational sources when it comes to copy trading. Look for reputable platforms, expert traders, and established financial institutions that offer reliable educational materials.

By making use of the educational resources available, you can gain a solid foundation in copy trading and improve your chances of success in the financial markets.

Recap copy trading as a viable Forex strategy in the financial markets

We have covered various aspects of copy trading, a revolutionary investment strategy in the financial markets. Let’s recap the key points:

- Introduction to Copy Trading: We introduced the concept of copy trading and how it allows investors to automatically replicate the trades of experienced traders.

- Trading Platforms for Copy Trading: We discussed the different online platforms that offer copy trading functionality and highlighted their features.

- Social Trading and Copy Trading: We explored the connection between social trading and copy trading, emphasizing the benefits of community-driven investment decisions.

- Investment Strategies in Copy Trading: We delved into various investment strategies that can be implemented in copy trading, such as diversification and risk-adjusted approaches.

- Risk Management in Copy Trading: We emphasized the importance of effective risk management techniques to safeguard investments in copy trading.

- Performance Statistics in Copy Trading: We highlighted how performance statistics provided by copy trading platforms can assist investors in evaluating potential traders to follow.

- Choosing Followed Traders in Copy Trading: We discussed the criteria for selecting followed traders, including their track record, trading style, and risk management practices.

- Regulations and Guidelines in Copy Trading: We touched upon the regulatory framework and guidelines that govern copy trading activities to ensure investor protection.

- Copy Trading Techniques: We explored advanced copy trading techniques, such as partial copying, manual adjustments, and auto-investing.

- Community Discussions and Support: We highlighted the value of participating in community discussions and seeking support from fellow copy traders.

- Educational Resources for Copy Trading: We provided insights into educational resources available to enhance knowledge and skills in copy trading.

With this comprehensive understanding of copy trading, we encourage you to explore this innovative investment strategy in the financial markets. Copy trading offers the potential for enhanced returns, reduced risks, and the opportunity to learn from experienced traders.

Don’t miss out on the benefits of copy trading. Take the next step and start your copy trading journey today!