Navigating the world of forex trading can be a daunting task, especially for those who are new to the game. With countless strategies, tools and market indicators to keep track of, it’s no wonder many traders feel overwhelmed. But what if there was a tool that could simplify the process and help you make more informed trading decisions? Enter forex signals – the key to unlocking your trading potential.

In this comprehensive guide, we’ll explore the ins and outs of forex signals, providing tips, strategies and insights to help you make the most of this powerful tool.

Demystifying Forex Signals: What are they and why should you care about them?

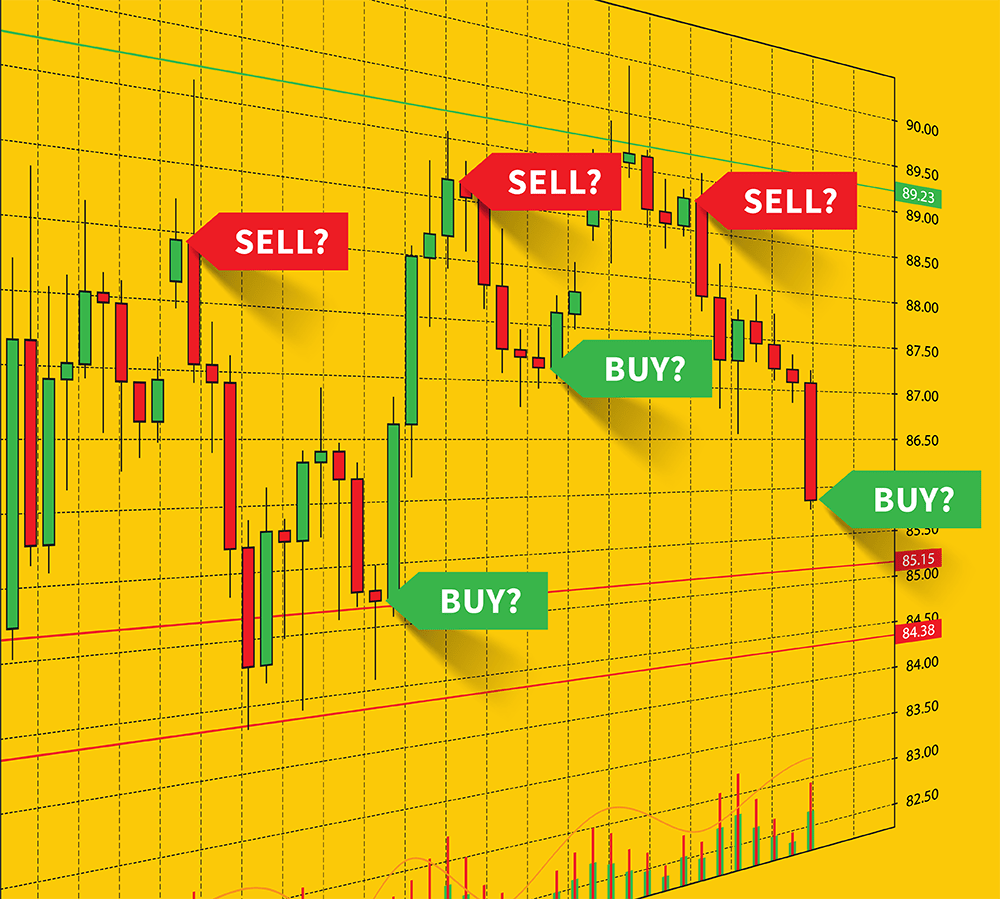

Forex signals are trading ideas or suggestions provided by experienced traders or automated algorithms, indicating when and how to enter or exit trades in the foreign exchange (Forex) market. These signals often contain important information such as entry price, stop loss and take profit levels, allowing traders to make informed decisions without having to perform in-depth market analysis.

But why should you care about forex signals? Simply put, they can help you save time, reduce the risks associated with trading and potentially increase your profitability. This is especially true for beginners who may not have the experience or knowledge to make sound trading decisions.

Forex Signal Anatomy: Deciphering the basics

Now that we understand the meaning of Forex signals, let’s break down their components. A typical Forex signal consists of the following components:

- Currency pair: The currency pair involved in the transaction, such as EUR_USD or GBP_JPY.

- Direction: Whether to buy (long) or sell (short) the currency pair.

- Entry Price: The recommended price at which to enter the trade.

- Stop Loss (SL): The price at which the trade should be closed if the market moves against you, limiting your loss.

- Take Profit (TP): The price at which a trade should be closed if the market moves in your favor, locking in your profit.

By understanding these elements, you will be better equipped to interpret and act on forex signals, maximizing their potential benefits.

Choosing the right forex signals provider: Tips for success

With so many forex signal providers, finding the right one can be a challenge. To help you make the best choice, consider the following tips:

- Reputation: Look for providers with a solid track record and positive reviews from other traders. This will give you confidence that their signals are reliable and trustworthy.

- Transparency: A reputable Forex signals provider should be transparent about their trading performance, offering detailed performance reports and statistics.

- Support: The best providers offer excellent customer support, ensuring that you can get help when you need it.

- Ease of Use: Forex signals should be easy to understand and follow, so look for providers that offer clear, concise signals with simple instructions.

- Cost: While it’s important to consider the cost of a Forex signals provider, don’t be tempted by the cheapest option. Instead, weigh the price against the value offered to determine the best fit for your needs.

By keeping these tips in mind, you will be well on your way to finding a forex signals provider that will help you succeed in the world of forex trading.

Building a trading strategy around forex signals: Best practices

Forex signals can be a powerful tool, but to take full advantage of them, it’s essential to incorporate them into a broader trading strategy. Here are some best practices for building a trading strategy around Forex signals:

- Risk management: Always use proper risk management techniques, such as setting stop losses and using appropriate position sizing. This will help protect your trading capital and minimize the impact of any losing trades.

- Stay informed: While forex signals can simplify the trading process, it’s still important to stay up-to-date on market news and events that may affect your trades. This will help you make better decisions and adjust your trading strategy when necessary.

- Diversify your trading tools: Forex signals should only be one part of your trading toolkit. Be sure to use other tools, such as technical and fundamental analysis, to develop a well-rounded trading strategy.

- Practice on a demo account: Before you start trading live with forex signals, it’s a good idea to practice in a demo account. This will allow you to gain experience and build confidence in your trading skills without risking real money.

- Monitor and adjust: Constantly monitor your trading performance and the effectiveness of the forex signals you use. Be prepared to adjust your trading strategy as needed to improve your performance and stay in line with your overall trading goals.

- Set realistic expectations: While forex signals can help you make more informed trading decisions, they are not a guarantee of success. Set realistic expectations for trading performance and be prepared for occasional losses.

By following these best practices, you will be better equipped to build a successful trading strategy that harnesses the power of forex signals.

Types of forex signals: Manual signals vs. automated signals

Forex signals can be broadly divided into two categories: manual signals and automatic signals.

Manual signals

Manual signals are generated by experienced traders who perform market analysis and share their trading ideas with subscribers. These signals may offer the benefit of human intuition and experience, but they can also be subject to human error and may be less consistent than automatic signals.

Automatic signals

Automated signals, on the other hand, are generated by computer algorithms or trading robots that analyze the market and generate trade ideas based on predefined criteria. Automated signals have the advantage of being fast, consistent and can process huge amounts of data. However, they can lack the human touch and can be susceptible to sudden changes in the market, which an experienced trader can handle better.

When choosing between manual and automated forex signals, consider your personal preferences, trading style and level of involvement in the trading process.

Unlock your trading potential with forex signals

Forex signals can be a valuable tool for traders looking to save time, reduce risk and increase profitability. By understanding the components of Forex signals, choosing the right provider and building a solid trading strategy, you can unlock the full potential of Forex signals and take your trading to new heights.

Remember that success in Forex trading requires patience, discipline and continuous learning. So hone your trading skills, stay abreast of market events and harness the power of forex signals to help you achieve your trading goals.

Huracan Trading: Your one-stop partner with forex signals and more

Now that we understand the importance of forex signals, let’s talk about a brand that can help you get started – Huracan Trading. Huracan Trading is a leading provider of Forex signals, cryptocurrency signals, trading education and trade copying services, making it a one-stop store for all your trading needs.

Forex Signals from Huracan Trading

Huracan Trading offers high-quality Fx signals backed by a team of experts and state-of-the-art technology. These signals are easy to understand and follow, making them ideal for traders of all experience levels. By using Huracan Trading’s forex signals, you can benefit from the knowledge of experienced professionals, giving you a better chance of success in the forex market.

Copy Trading: Enhancing your trading success

But Huracan Trading doesn’t stop at forex signals. It also offers copy trading services, allowing you to automatically mimic the trades of experienced traders. This means you don’t have to spend hours analyzing charts or studying market news – you can simply follow the example of successful traders and reap the benefits.

Copy trading with Huracan Trading is a great way for beginners to learn from experienced traders and for busy people to maintain an active trading portfolio with minimal time investment. Also check out the copy crypto service on the Bybit platropha.

Crypto Signals: Expanding your trading horizons

The world of cryptocurrency trading can be daunting, but Huracan Trading’s cryptocurrency signals make it more accessible. Like Forex signals, cryptocurrency signals provide trading ideas and suggestions for the rapidly changing and volatile world of cryptocurrency trading.

By incorporating cryptocurrency signals into your trading strategy, you can expand your trading horizons and potentially increase your profits. Huracan Trading’s cryptocurrency signals are backed by the same expertise and technology that powers their forex signals, ensuring that you receive accurate and timely information to help you make informed trading decisions.

Trading education: investing in your trading future

Huracan Trading recognizes the importance of continuous learning in the world of trading and therefore offers a comprehensive trading education program. This program covers everything from basic trading concepts to advanced strategies, helping you become a well-rounded and successful trader.

By investing in trading education, you will be better equipped to understand the rationale behind the Forex and Cryptocurrency signals provided by Huracan Trading, allowing you to make more informed decisions and potentially increase your profitability.

Forex signals can be a powerful tool for traders looking to save time, reduce risk and increase profitability. Huracan Trading offers high-quality Forex signals, along with a suite of other services, such as copy trading, cryptocurrency signals and trading education, to help you become a successful trader.

By following our step-by-step guide, you can begin your journey with forex signals and take advantage of the knowledge and technology offered by Huracan Trading. So, what are you waiting for? Sign up with Huracan Trading today and take your trading to the next level!